Read more on bayoubrief.com

During the past two weeks, through our investigative series “Wrecked: How Auto Insurance Takes Louisiana for a Ride,” the Bayou Brief has revealed how Louisiana motorists with perfect driving records often pay significantly higher premiums for basic auto insurance because of things that have nothing to do with how safe they are when they get behind the wheel.

A 60-year-old driver will find that some of the state’s largest insurers will raise her annual premium by as much as $172 after her spouse passes away. Another driver, who has never been ticketed or caused an accident, could face a nearly $1,600 premium penalty if he has a low credit score, and that’s just to buy the basic coverage required by state law. These are just a few of the ways that insurance companies have moved away from pricing customers based on how they drive and, instead, charging premiums tied to algorithms that place a lot of weight on personal and economic characteristics.

Put simply, in Louisiana, auto insurers have a license to discriminate.

On Wednesday, members of the state Senate Insurance Committee will conduct a second round of hearings on SB 89. Authored by state Sen. Jay Luneau, SB 89 is the first and only proposal in state history that would prohibit auto insurers from discriminating against widows and widowers or on the basis of gender or credit score.

For decades, the industry’s practices have either largely been ignored or simply accepted as standard. But there is nothing standard or acceptable about the kind of institutionalized and pernicious discrimination currently allowed in Louisiana.

Women may be charged more than men, and in a state where women are paid 68 cents for every dollar paid to men, the impact can be significant.

While a person’s credit score does not always directly correspond with their income, it usually does, and in a state that struggles with poverty, that means poor and lower-middle class drivers are disproportionately burdened.

Four years ago, a study by the Consumer Federation of America revealed that African American drivers pay 70% more than white drivers for car insurance, and it should come as no surprise that a state in which nearly one-third of the population is African American is also one of the most expensive places in the country for basic auto liability coverage.

Handing the premium setting of auto insurance over to these non-driving related algorithms is, obviously, unfair to the millions of Louisiana drivers who don’t have the right marital status or credit score. Just as importantly, it also harms public safety and contributes to high auto insurance rates.

When done properly, insurance pricing should send a signal to customers about how to lower their risk and, in turn, lower their premium. If you drive safely, you get a low price. If you drive a safe car, you get a low price. If you are wild on the road and your vehicle has a history of dangerous rollovers, you pay more. The premium drivers are charged will reinforce safety and incentivize higher risk drivers to change their behavior.

But what signals do consumers get nowadays when they open up their insurance bill?

“Fix your credit.” “Don’t let your husband die.” Or, at least, “Remarry soon after the funeral.”

If you can’t address those personal issues, you can’t lower your premium. But if you stay married and maintain an excellent credit score, you can be convicted of drunk driving and still pay a comparatively lower rate.

Insurance companies claim that these new pricing systems are the result of complex, data-driven research. But, really, the industry is just being lazy and greedy.

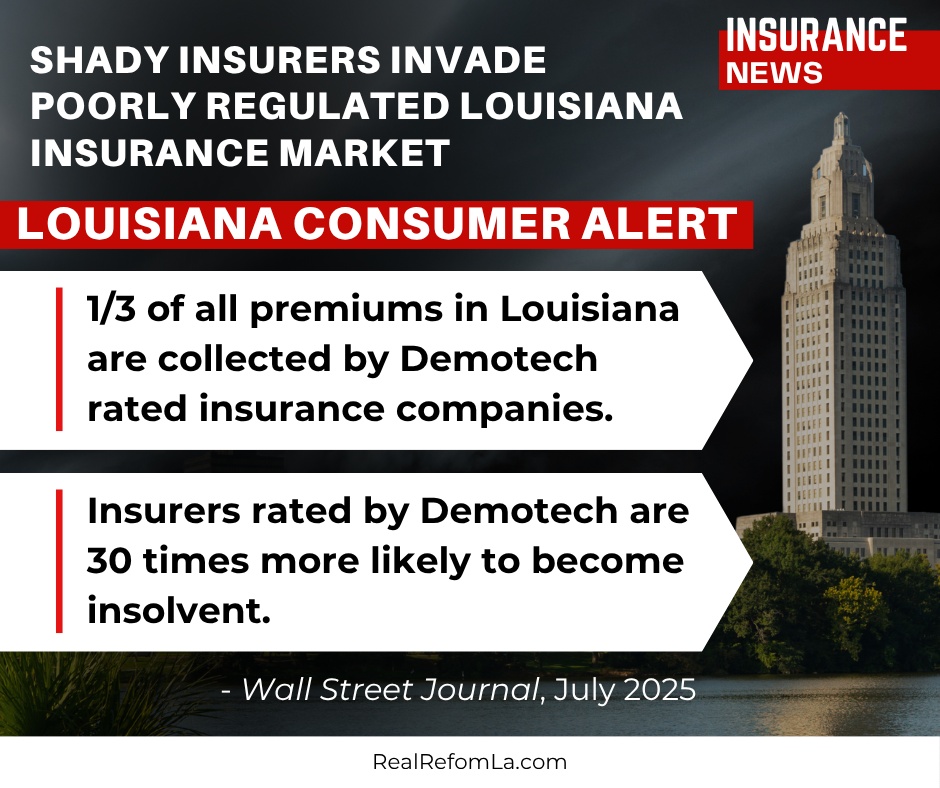

Credit penalties are jacking up home insurance rates that are crushing Louisiana policyholders. Year after year, the insurance industry opposes real insurance reforms that would lower rates by prohibiting insurers from penalizing Louisiana policyholders with poor credit. And year after year, the Louisiana legislature sides with industry, rejecting these basic consumer protections. Now, the Consumer Federation of America has published a bombshell report that calculates the price Louisiana policyholders pay for Commissioner Temple’s and the legislature’s allegiance to big insurance. According to the report, home insurance companies operating in Louisiana mark up home insurance policies an average of $3,754 for customers with poor credit; that’s an 87% increase. For those with middling credit, there is an increase of $1,503, a 35% increase. Home insurance should be based on risk, not credit. The tactic is particularly harmful in Louisiana, where we have the second-lowest average credit score . This unjust tactic unfairly penalizes individuals with poor credit, resulting in outrageous home insurance premiums in Louisiana that significantly exceed the risks associated with the policy. Louisianans can no longer afford to listen to the insurance industry. We are putting the fox in charge of the hen house. Louisiana desperately needs real insurance reforms that lower rates, protect consumers, and hold big insurance companies accountable. Real Reform Louisiana is a member of the Consumer Federation of America.

Is Louisiana in Good Hands with Commissioner Temple? Commissioner Tim Temple received nearly 75% of his campaign contributions from the insurance industry, as reported in the Advocate-Times Picayune. Commissioner Temple is a former insurance executive whose family owns an insurance company. Temple has pushed a radical anti-consumer agenda since being elected without opposition in 2023. Temple lifted profit caps for insurers, made it easier for them to raise rates, deny claims, and cancel policies —all while pushing legislation that makes it harder for Louisiana policyholders to file claims and hold insurers accountable. At the same time, insurance companies are reporting record profits. In 2024, the industry reported a 91% spike in profits, reaching a record $166.8 billion! In Louisiana, auto insurers had the third-highest profit in the country, while home insurers have reported $55 profit for every dollar lost since 2004. In short, Big Insurance has gotten its money's worth. Commissioner Temple’s job is to regulate the industry that funded his campaign. But instead of regulating insurance companies, Commissioner Temple has repeatedly pushed the industry’s agenda. Temple is regulating the people of Louisiana, making it harder for them to get claims paid and hold their insurer accountable. It’s a blatant conflict that should concern every Louisiana citizen and give pause to lawmakers following Temple off the tort reform cliff.

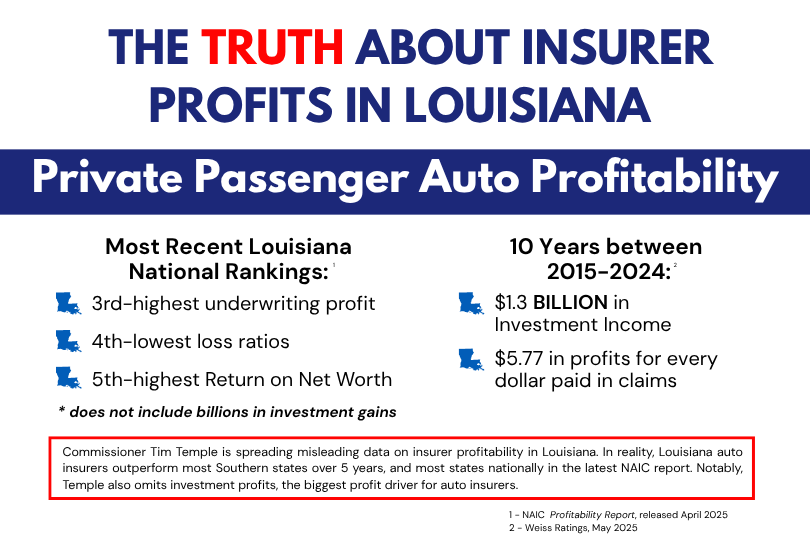

The truth about insurer profits in Louisiana. Insurance Commissioner Tim Temple is a former insurance executive whose family owned an insurance company. Temple received nearly 75% of his campaign contributions from the insurance industry. During this legislative session, Commissioner Temple has pushed a radical, pro-insurance agenda that pads insurer profits by stripping policyholders and accident victims of their rights. To advance that agenda, Commissioner Tim Temple has pushed misinformation about the profits of insurers operating in Louisiana. Here are the facts about insurer profits in Louisiana: As Warren Buffet (who owns GEICO) explains in this shareholder letter , auto insurance companies make most of their profits from investing your premium dollars, not underwriting insurance policies. Nevertheless, Louisiana was one of 18 states to make an underwriting profit, according to the most recent NAIC profitability report. Louisiana had the third-best underwriting profit nationally according to the report. But investments are where they make the big bucks: According to a recent report from Weiss Ratings , auto insurers operating in Louisiana made $1.3 BILLION in investments between 2015-2024, which comes to $5.77 for every dollar lost in underwriting. While the highest rates in the nation are a key chunk of insurers' big profits in Louisiana, another significant component is denying claims. Private passenger liability claims closed without payment has increased from 39.2% of total claims in 2015 to 45.2% in 2024, according to Weiss. The truth is BIG INSURANCE COMPANIES are raking in record profits while Louisiana families and small businesses are paying unaffordable rates and seeing their claims denied at an alarming rate.

5 Facts About Louisiana's Insurance Market. 1) High Rates: Louisianans pay the highest auto insurance premiums in the nation ($3,481 per year) and the 5th highest home insurance premiums ($4,291). - Marketwatch/Bankrate, June 2025 2) Huge Profits: Auto insurers operating in Louisiana have the 3rd highest underwriting profit in the country, meaning they charge high premiums and pay out less in claims. - NAIC, April 2025 3) $55 profits for every $1 lost: Since 2004, home insurers operating in Louisiana made $88.3 billion investing your premium dollars and reported just $1.6 billion in underwriting losses, meaning they made $55 profit for every dollar they lost. - Weiss, May 2025 4) Not paying Claims: Home insurers operating in Louisiana denied 44.6% of claims filed in 2024, which is significantly above the national average. Auto insurers denied 45.2% of private passenger liability claims in 2024. -Weiss, May 2025 5) Tort Reform Does Not Work: Rates are still high, insurers are making record profits, while denying claims at an alarming rate. It’s obvious: tort reform guts consumer protections to pad insurer profits.

Louisiana families struggle, as corporate fat cats live high on the hog! The latest numbers are in, and they're appalling. In 2024, Property & Casualty insurers reaped a staggering $170 BILLION in profits —a 91% jump from 2023 and a jaw-dropping 330% surge from 2022! Meanwhile, their executives are rolling in dough, with 9 of the top home insurers' executives pocketing a whopping $310 MILLION in compensation. Who's footing the bill? Sadly, it is Louisiana policyholders . Louisianans pay the second-highest annual premium in the nation—with t hat number expected to rise another 27% by the end of 2025 . Nevertheless, year after year, the industry and its allies in the legislature pass tort reform laws that gut consumer protections. As a result, nearly half of all claims in Louisiana are closed without payment. Due to sky-high rates, a lax regulatory environment, and weak consumer protections, property insurers operating in Louisiana have raked in a shocking $55 in profit for every dollar they have lost over the last 20 years. Moreover, automobile insurers in Louisiana are also making out like bandits, as rates are among the highest in the nation despite auto insurers operating in Louisiana having the 3rd highest profit and some of the best loss ratios in the country. We cannot afford to sit idly by while Louisiana families and small businesses struggle to get by and these corporate fat cats live high on the hog! Tort reform does not lower rates. It pads the profits of big insurers and stuffs the pockets of executives. We must pass real insurance reforms that lower rates, hold insurers accountable, and strengthen consumer protections.

Rates Continue to Climb as Claims Paid Decrease Weiss Ratings, the nation's leading independent rating agency, issued a bombshell report that sheds light on "three alarming trends" with property insurers operating in Louisiana. The big takeaway: Tort reform does not work. The central argument from proponents of tort reform is that cutting costs for insurers will result in savings for policyholders. However, the data suggests that insurers are closing a startling number of claims without payment as rates continue to climb. According to Insurify , Louisiana rates are expected to rise another 27% in 2025, following a 38% increase in 2024. Additionally , Weiss Ratings found that eight property insurers who received taxpayer dollars through the Insure Louisiana Incentive Program "have a long history of poor business performance" and "above-average claims denials." Three Alarming Trends Insurance companies operating in Louisiana closed nearly half of homeowners' claims (44.6%) with no payment in 2024, which is significantly higher (+2.7%) than the national average and 18.9% higher than the national average in 2004. This highlights the devastating effects of tort reform. According to Weiss Ratings , seven companies operating in Louisiana closed more than 50% of their claims with no payment. Kin Insurance (68.3%) and Spinnaker Insurance (60.6%) closed more than 60% of claims with zero payment. Insurance companies operating in Louisiana have raked in "$88.3 billion from investments and other sources," far exceeding their "$1.6 billion in underwriting losses," which insurers often use to justify rate increases and tort reforms that gut policyholders' rights. "That’s $55 in profits for each $1 of underwriting losses," according to Weiss. Insurers operating in Louisiana moved $27.1 billion off the books to affiliates, effectively hiding these funds from regulators, lawmakers, and the ratepaying public. This could also account for a significant percentage of the underwriting losses reported by insurers operating in Louisiana. “Louisiana homeowners are being shortchanged by insurers prioritizing profits,” said Dr. Martin D. Weiss, founder of Weiss Ratings. “Regulators must act, and homeowners should choose insurers with fair practices and strong ratings.” Poor Stewards of Taxpayer Dollars The Insure Louisiana Incentive Program used taxpayer dollars to encourage insurers to write policies in Louisiana, particularly in storm-prone areas and to help depopulate the rolls of Citizens, the insurer of last resort. According to Weiss , the eight insurers approved to receive grant funds have reported "net underwriting losses of $357 million" over the last ten years. These insurers have shifted $174 million in fees to affiliate companies, off the books and out of sight of regulators, which accounts for 48.4% of their total underwriting losses. "On average, the eight companies closed 42.1% of claims with no payment in 2022, an even higher 45% in 2023, and an alarming 51.1% in 2024," according to Weiss. This disturbing trend demonstrates that insurers cannot be trusted to act in the public's interests with taxpayer dollars, as well as the devastating effects of tort reforms, which make it harder for policyholders to file claims. "We've heard the insurance industry repeatedly promise that tort reforms will reduce costs and ultimately lead to savings for policyholders. Sadly, we have seen rates continue to climb as the number of claims paid decreases," said Ben Riggs, executive Director of Real Reform Louisiana. "We cannot continue to trust and cater to the insurance industry. Louisiana families and small businesses desperately need real insurance reforms that lower rates, protect policyholders, and hold insurers accountable."