Temple Continues Legacy of Broken Tort Reform Promises.

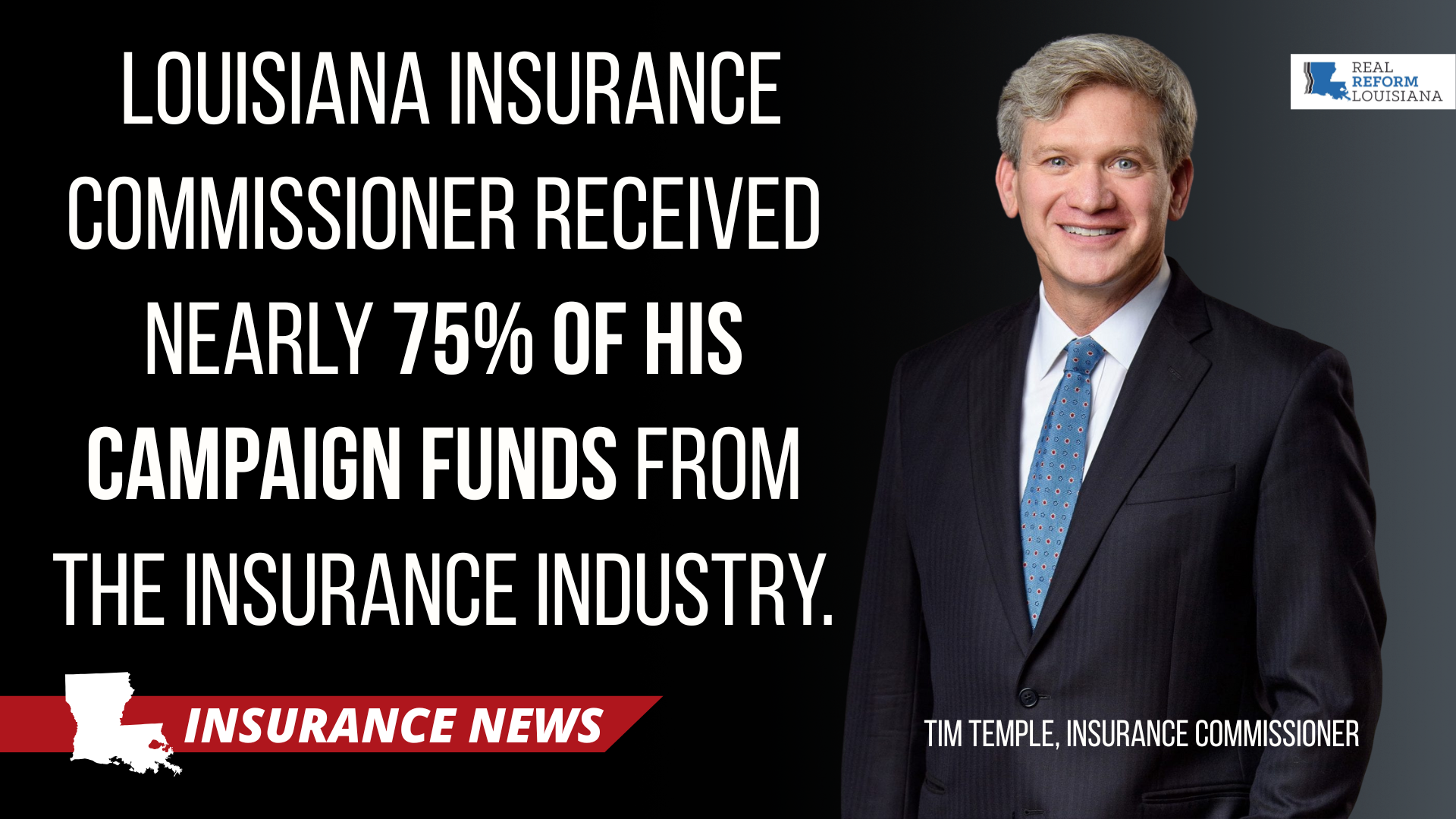

Commissioner Tim Temple is once again before the legislature pushing a radical package of tort reform measures that will gut consumer protections and strip policyholders of their rights.

Temple took this same approach last year. Did it work? Well, the results are in, and they could not be more disappointing for rate-payers in the Bayou State.

According to a new report from Insurify, "Louisiana will see the largest cost increase of any state by the end of 2025, with rates expected to rise 27% — nearly $3,000 — to $13,937. This follows a 38% increase in home insurance premiums in 2024."

Homeowners in Louisiana are expected to pay roughly four times the national average for home insurance in 2025. This comes after Temple fleeced Louisiana policyholders of their rights and protections last year.

In 2024, Commissioner Temple repealed Louisiana's three-year rule, making it easier to cancel or non-renew property insurance policies. He also made it easier to delay and deny claims, and weakened penalties for those acting in bad faith. All this was, according to Temple, designed to make Louisiana more attractive to insurers, increase competition, and drive down prices.

Temple's plan is another failed promise of tort reform—and we cannot afford to follow him off the cliff again!

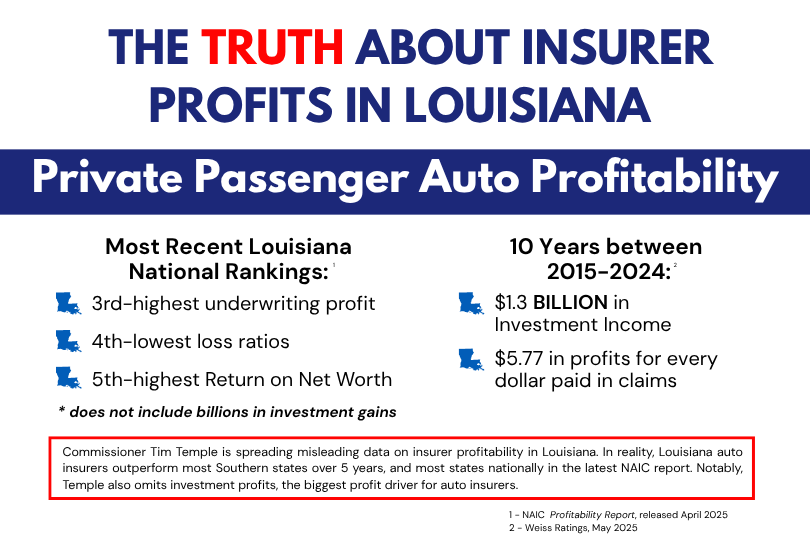

Louisiana knows all too well about tort reform's broken promises. Similar measures passed in 2020 were promised to lower auto insurance premiums in Louisiana by as much as 25%. Unfortunately, auto insurance premiums have skyrocketed every year since.

Louisiana is the most unaffordable state for insurance in the nation, with nearly $1 out of every $10 earned going to insurance costs. Louisiana cannot afford more failed promises. We need real insurance reforms that lower costs, protect consumers, and hold big insurance companies accountable.

Real Reform Louisiana supports legislation currently before the Louisiana legislature that empowers the Commissioner to reject excessive rates, demands more transparency, and prohibits the use of credit scores in rate-making.