Louisiana Department of Insurance hosts seminars on how insurance industry can defeat policyholders in legislature and legal system

by Eric Holl, Executive Director, Real Reform Louisiana

March 9, 2022

We’re in a full-blown insurance crisis across South Louisiana as thousands of families and business owners get taken advantage of by their insurance companies. But to listen to Insurance Commissioner Jim Donelon and the insurance lobbyists he invited to speak at his annual LDI conference on Monday and Tuesday, the real crisis is that the legislature might actually do something to give hurricane victims a fighting chance when they file a claim.

The conference saw the launch of a full-scale effort by the commissioner and his industry allies to downplay the issues Louisianans are having with insurance. They indicated they will do everything possible to maintain the unacceptable status quo with platitudes and feel-good legislation that does little to change the insurance environment. If they’re successful it will ensure that more Louisianans will suffer the same abuse from insurance companies after the next storm.

You can view the conference agenda here. Here are some of the informational sessions that were offered that we attended:

- “Observations in the Louisiana Property & Casualty Market” – in which insurance industry lobbyist Ronnie Johnson claimed hurricane victims buy boats with their insurance check instead of making repairs and praised Donelon (who was present at the meeting) for authoring legislation that is “favorable” to the industry as an alternative to pro-consumer legislation that has been filed in response to South Louisiana’s insurance crisis.

- “The Agent Perspective” – In which prominent insurance lobbyist Jeff Albright and other lobbyists for insurance agents talked about how lobbyists “work very closely” with Donelon who “would be out in front” during session to ensure the industry’s interests are protected at the capitol. Donelon thanked Albright for “the work that we’ve been doing in preparing for what is truthfully going to be the most important session in my tenure.”

- “Beating Bad Faith After Laura, Delta, and Ida” – In which insurance defense attorney Matthew Molson gave advice on how insurance companies can avoid paying penalties when they get caught improperly withholding payment from policyholders.

- “Social Inflation and its Effect on the Insurance Market” – in which insurance industry advocate Lars Powell argued that big insurance companies shouldn’t have to pay for an accident victim’s medical care for severe injuries caused by a truck because “if you think about a person’s behavior before they had the loss, they weren’t acting like that was worth tens of millions of dollars or they would’ve stayed home.”

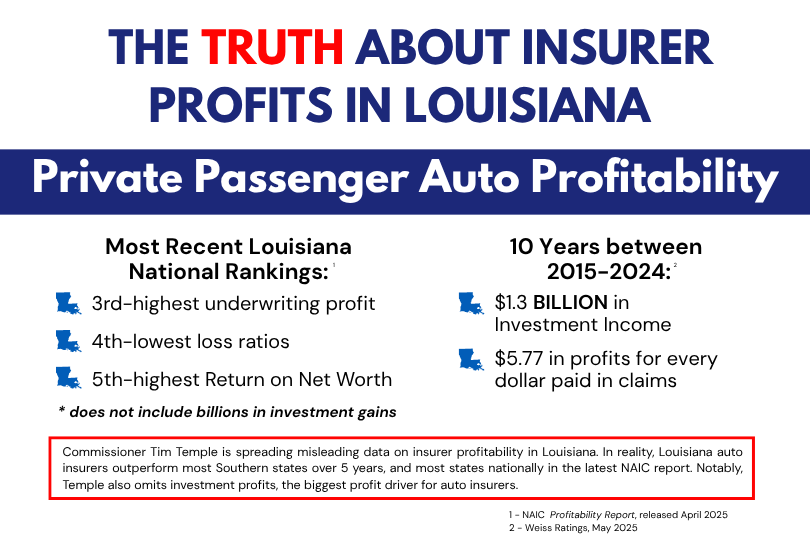

It’s shameful, but it’s no surprise coming from the insurance commissioner that has overseen Louisiana’s market as we have become the most expensive state for car insurance and allowed insurance companies to run roughshod over thousands of South Louisiana hurricane victims. The insurance commissioner shouldn’t be teaming up with the insurance industry to fight against policyholders, but if the LDI conference is any indication, that’s what we’ll see during this legislative session.