Big Insurance is Slashing Claims Estimates. HB 287 Levels the Playing Field.

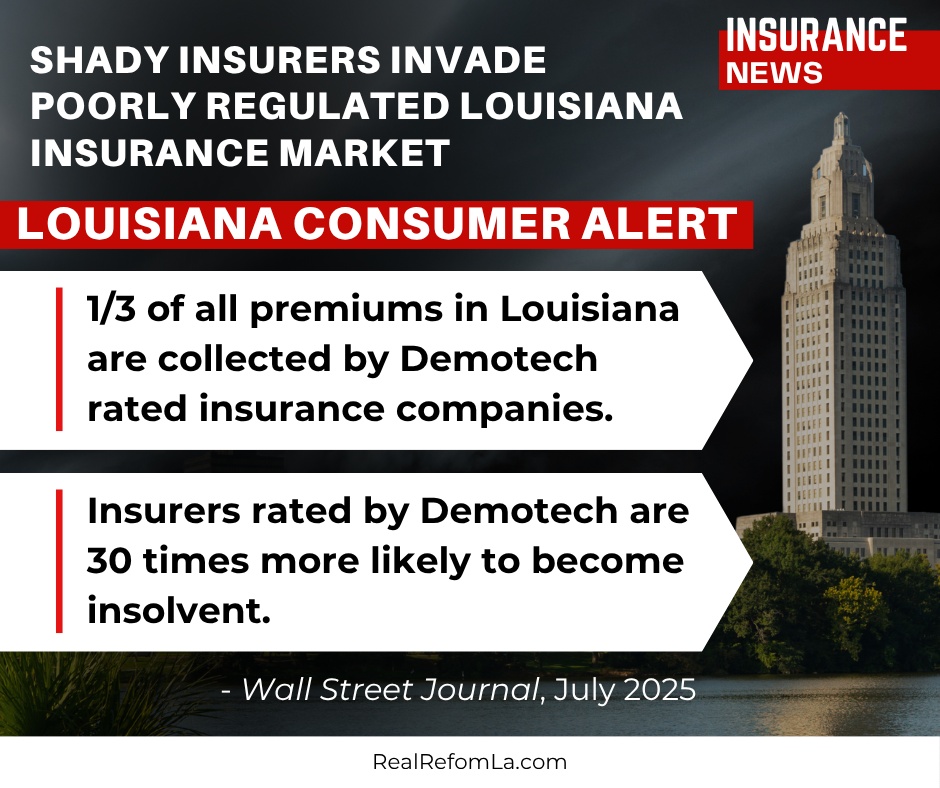

Big insurance companies are getting caught red-handed slashing field adjuster’s initial estimates and lowballing storm victims. This makes it nearly impossible for Louisiana families and small businesses to rebuild and get their lives back on track. It also undermines the field adjuster’s expertise.

HB 287 is a pro-consumer transparency bill that provides policyholders with a copy of the adjuster’s initial estimate and supporting documents. HB 287 does not impose burdensome time constraints or extra work on the field adjuster. Instead, it requires the insurer to provide the policyholder with a copy of the estimate upon receipt through a customer portal, via email, or upon request if the policyholder has not signed up for online services or provided an email.

HB 287 is a necessary protection for both consumers and field adjusters. Insurance companies often gut the initial estimate without notifying the policyholder or the field adjuster.

A Hurricane Ida victim in Cutoff, Louisiana was offered just 20% of the field adjuster’s estimate. “They changed my estimate completely. I couldn’t believe it,” said Joseph Lahatte, the adjuster. “I stopped working for UPC after that.”

This shameful practice is not limited to Louisiana. According to a Washington Post analysis, some Florida policyholders and their families saw their Hurricane Ian claims slashed by 45-97%. The Post also reported that “managers have been changing their (adjusters) work by lowering totals, rewriting descriptions of damage and deleting accompanying photos without their approval.”

HB 287 ensures that the insured and insurer have access to the same documents and information pertaining to the policyholder’s claim. It provides much-needed transparency, levels the playing field, and protects policyholders and adjusters alike.

Contact your legislator and ask them to support HB 287.