New Year, Same Problem

As we enter the new year, Louisiana faces a familiar crisis.

Property insurance rates are skyrocketing, rising 27% between May 2022 and May 2023. Insurance companies universally state prices are going up and coverage is diminishing due to severe storms, the unpredictable nature of these storms, and the increased cost of repairs because of inflation.

While this crisis is driven by natural disasters, Louisiana's problem is man-made. We ignore the fact that big insurance companies want to exploit the crisis to increase their profits, and we continue to allow the insurance industry to dictate our solutions. Louisiana has put the fox in charge of the hen house.

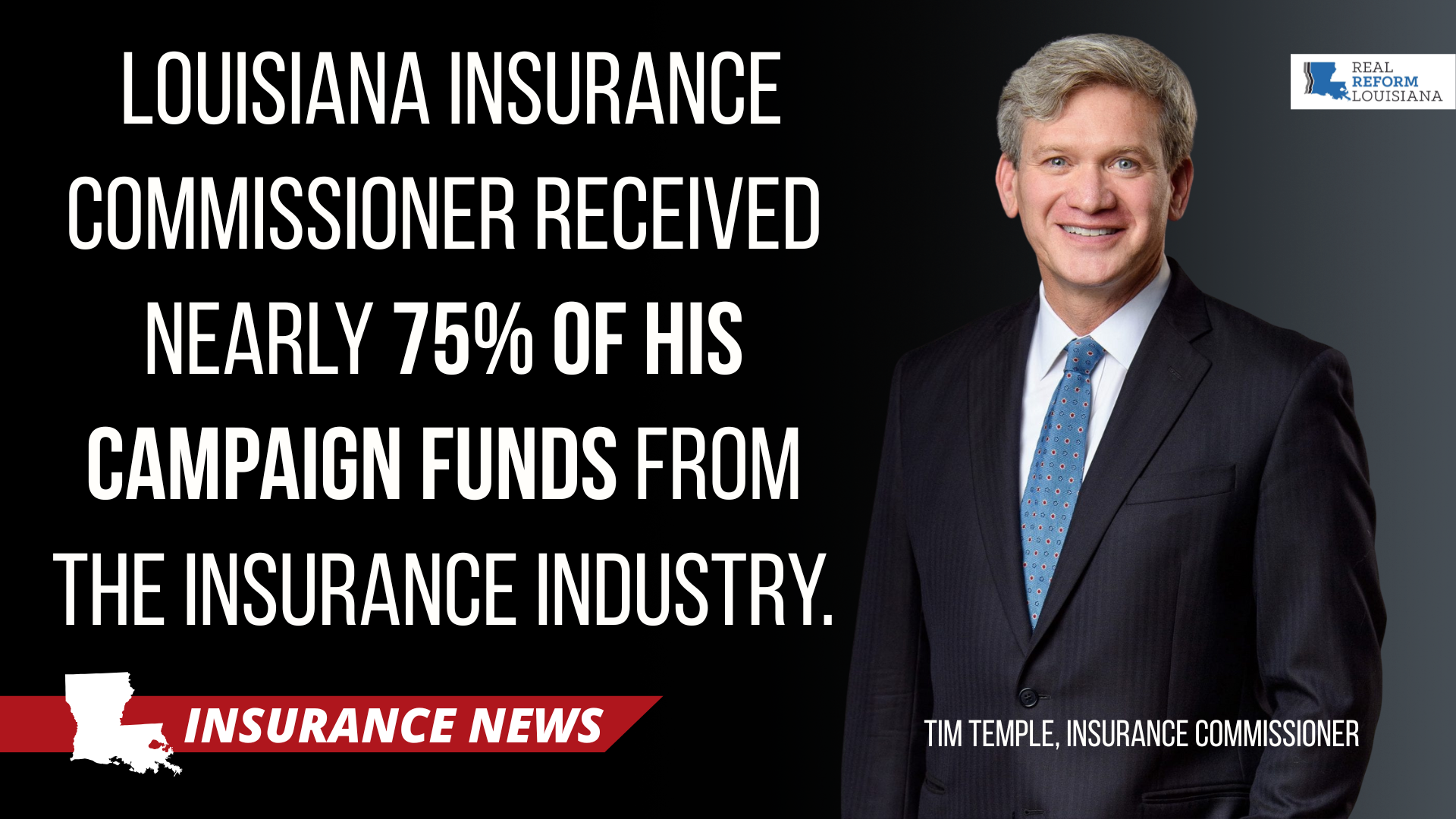

Unfortunately, commissioner Tim Temple's agenda is more of the same. Temple wants to stack the deck more in favor of big insurance at the expense of Louisiana consumers by doing the following:

- Weaken or eliminate the three-year rule

- Make it harder to hold insurers accountable

- Allow big insurance companies to cherry-pick where they write policies

- Make it easier for insurers to delay and deny claims

- Raise rates more often

These anti-consumer, pro-industry measures will not invite new insurers to write policies in Louisiana because they fail to address the weather-related reasons insurers are weary of Louisiana. Instead, Commissioner Temple's agenda benefits companies already in our state at the expense of Louisiana families and small businesses, leading to significant rate increases, diminished coverage, and making it harder for homeowners to hold their insurers accountable.

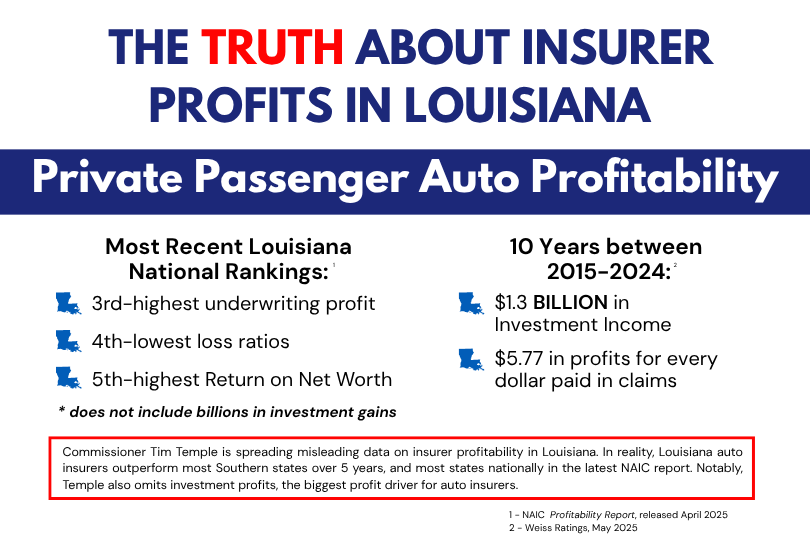

Big Insurance continues to rake in billions in profits, and Swiss Re projects these profits will increase in 2024 as a result of higher premiums, strong investment returns, and improved interest rates. We cannot allow insurance companies and industry-friendly officials to exploit natural disasters at the expense of homeowners.

Lower Rates by Mitigating Risks in 2024

Louisiana desperately needs solutions that lower rates and help hold big insurance companies accountable. We must upgrade our housing stock to better withstand hurricanes and mitigate the risk for insurers. We accomplish this goal by investing in and expanding the roof fortification program.

Louisiana families and small businesses cannot afford more industry-backed legislation designed to increase profits and strip consumer rights. Louisiana needs real reforms that lower costs, increase competition, and hold Big Insurance accountable.