Safe drivers with bad credit are penalized in Louisiana, leading to higher auto insurance rates.

The Consumer Federation of America (CFA) released a study yesterday detailing the negative impact using credit scores to set auto insurance prices has on good drivers in Louisiana.

Safe Drivers Pay More

In Louisiana, safe drivers with poor credit pay an average of $905 more than drivers with a DWI and excellent credit ($3,548 / $2,643). Using credit scores in price setting creates a perverse incentive structure that rewards dangerous drivers and unfairly penalizes good drivers.

“On average, a consumer with poor credit has to pay twice as much for auto insurance as a driver with excellent credit, even if everything else, including their driving safety history, are the same,” said Douglas Heller, CFA’s Director of Insurance and the study’s co-author. “Not only is this unfair to safe drivers, because of longstanding and institutional biases, the use of credit history for insurance pricing leads to disproportionately higher premiums for lower-income drivers and people of color.”

Why Louisiana Drivers Pay More

This report reveals a key reason Louisianans pay more for auto insurance. Louisiana ranks 48th in median household income and 49th in average credit score. According to CFA’s study, safe drivers with poor credit pay 111% more than safe drivers with excellent credit ($1,505 / $713). Consequently, Louisiana has the second-highest auto insurance rates in the nation. In fact, Louisiana is one of only ten states where the annual expenditure for auto insurance exceeds $1,362, according to NAIC.

According to the most recent state-specific data, State Farm is the largest auto insurer in Louisiana, with 31.62% market share. The CFA’s analysis, which included data from Louisiana, found that “State Farm charges people with fair credit a 78% surcharge over the premiums charged to excellent credit drivers, and it charges poor credit customers a 224% surcharge on average.”

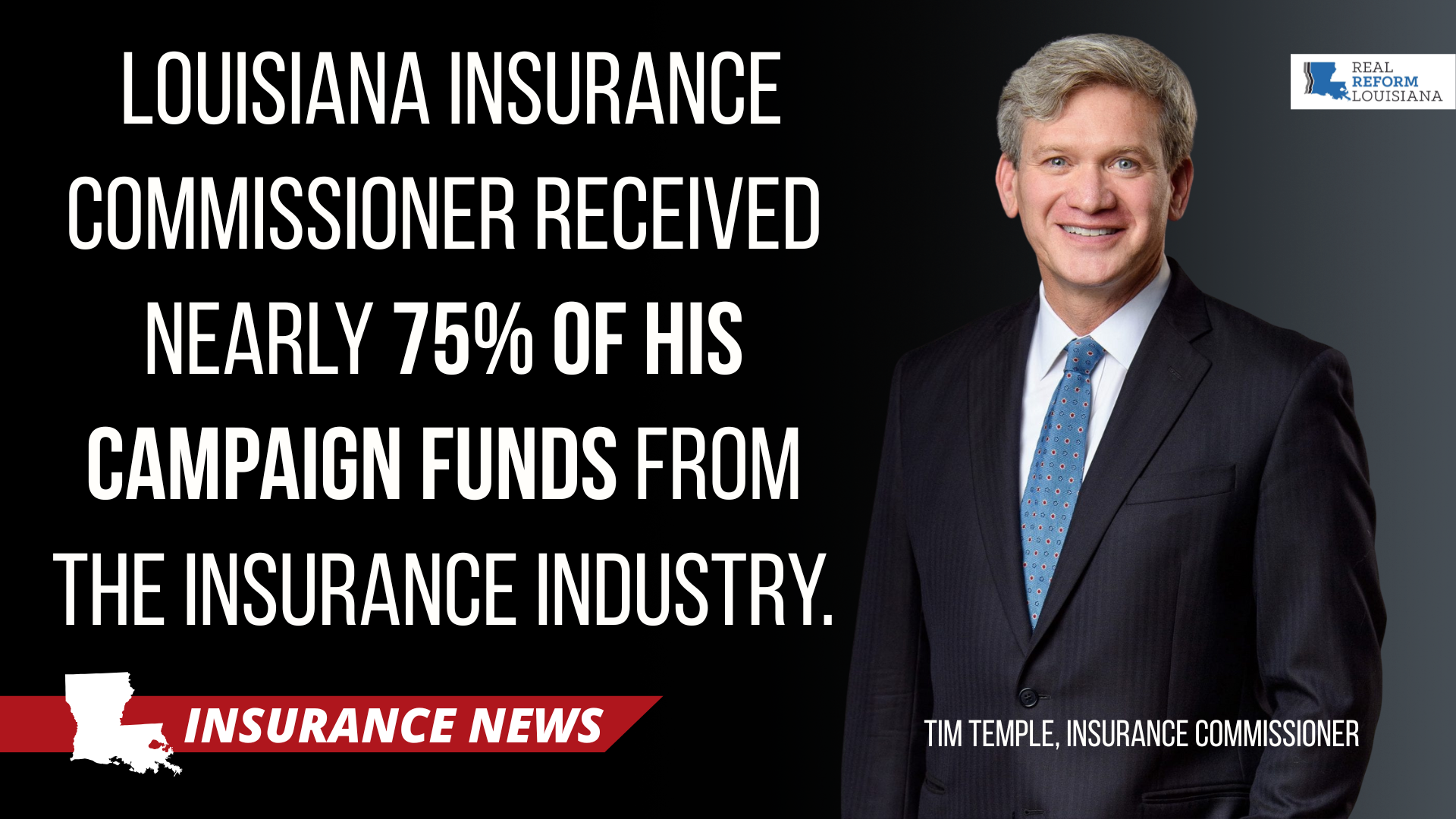

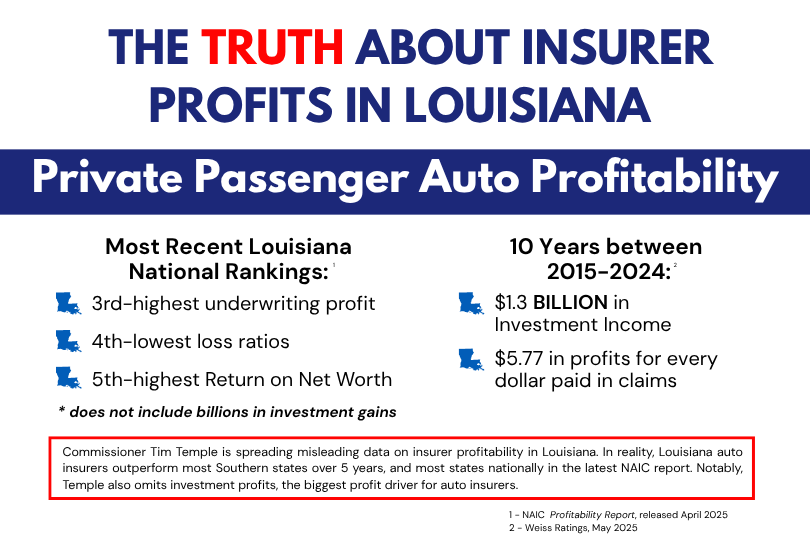

“We must stop letting the fox guard the hen house by listening to big insurance companies when it comes to lowering rates,” said Ben Riggs, executive director of Real Reform Louisiana. “The truth is they are using non-driving related factors, like credit scores, to increase premiums, penalize good drivers, and pad their profits. Louisianans deserve real insurance reforms that prohibit unfair practices like this and lower costs."

The Solution

Three states have passed laws to prohibit using credit scores in setting insurance prices: California, Hawaii, and Massachusetts—all of which have cheaper auto insurance than Louisiana. If lawmakers are serious about lowering auto insurance rates for Louisiana drivers, the State Legislature should make Louisiana the 4th state to ban the use of consumer credit information in auto insurance price setting.

Read more in the story below ⬇️