Judicial Hellholes list again phony, misleading, harmful to Louisiana

February 2, 2023

A phony list that consistently ranks Louisiana as one the nation’s “Judicial Hellholes” has re-entered the public discourse, and it couldn’t have come at a worse time.

In a recent Letter to the Editor, State Senator Robert Mills references the latest report, arguing that “Louisiana’s civil justice climate impacts the state’s ability to attract and retain business.”

If it were true that the judicial atmosphere in Louisiana discourages businesses from investing in our state, then incredibly profitable oil and gas companies wouldn’t do business here.

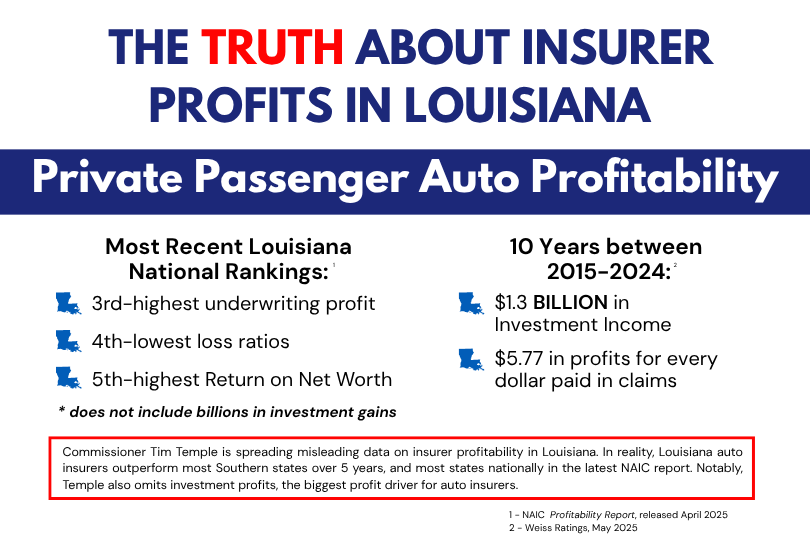

The report is put together by corporate lobbyist organization The American Tort Reform Foundation, which is the same organization that promised us our car insurance rates would go down by 25% if we passed tort reform. Instead, our rates are going up.

This is a misleading report based on anecdotal evidence - with no empirical aspect of the study evident - presented by corporate lobbyists. These same lobbyists strategized to tie tort reform to insurance rates, intending to “excite Joe Six-Pack” into supporting policies that actually pad corporate profits.

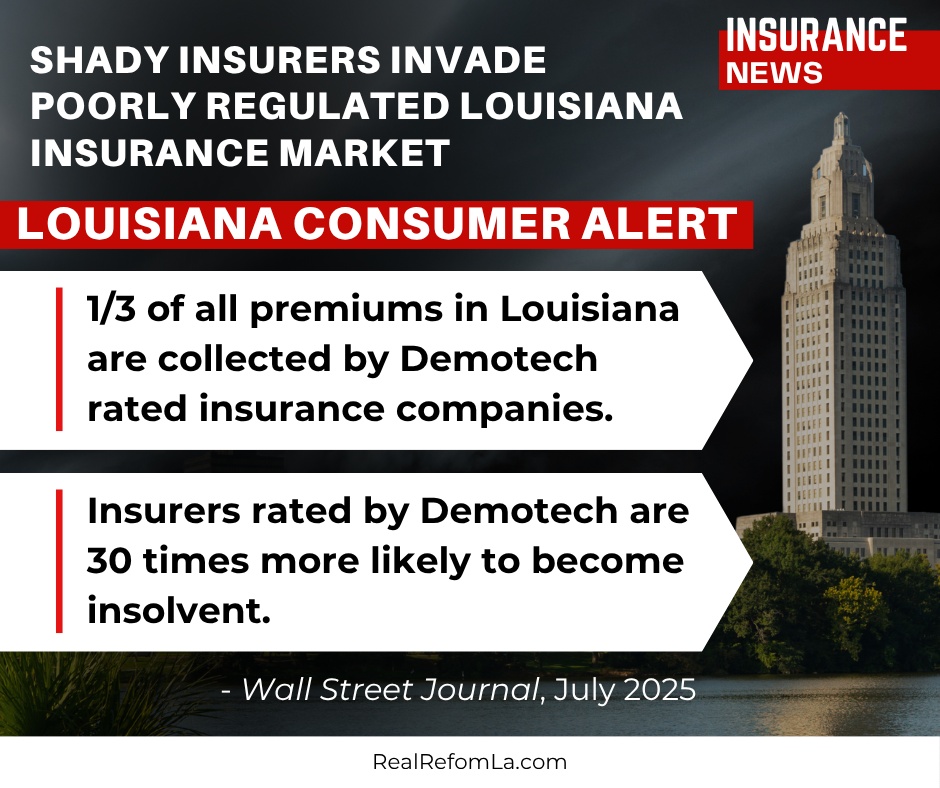

The timing is profound as our legislators are currently in a special session to fund an incentive program that aims to lure insurance providers to the state. A similar proposal was used after Hurricane Katrina to - at-best - mixed results - with the vast majority of insurers attracted folding or leaving the state.

Some say the definition of insanity is doing the same thing over and over, expecting a different result. Insurance Commissioner Jim Donelon says our only option (outside of going uninsured) is to try this same failed incentive program, again. That’s tough to believe coming from a man who gets most of his campaign funding from insurance companies, agents, and lobbyists.

We need real insurance reform, not more laws written by corporate lobbyists to rig the system for big insurance.