By Ben Riggs

•

May 13, 2025

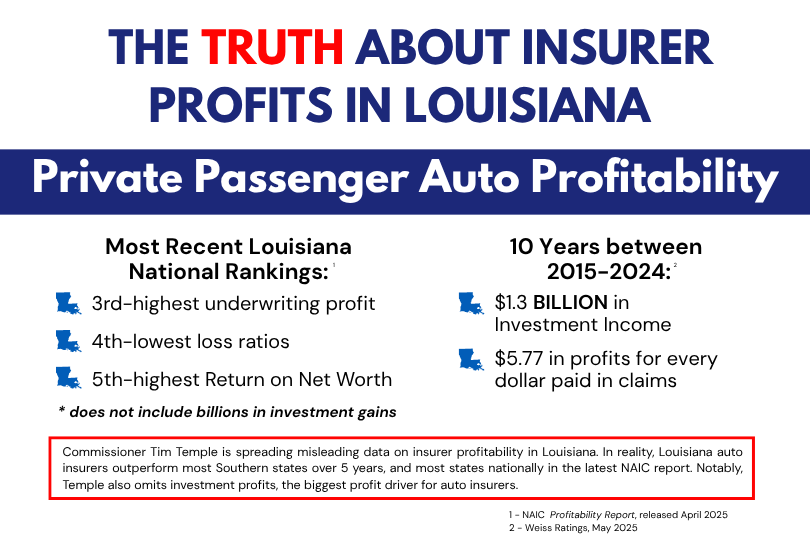

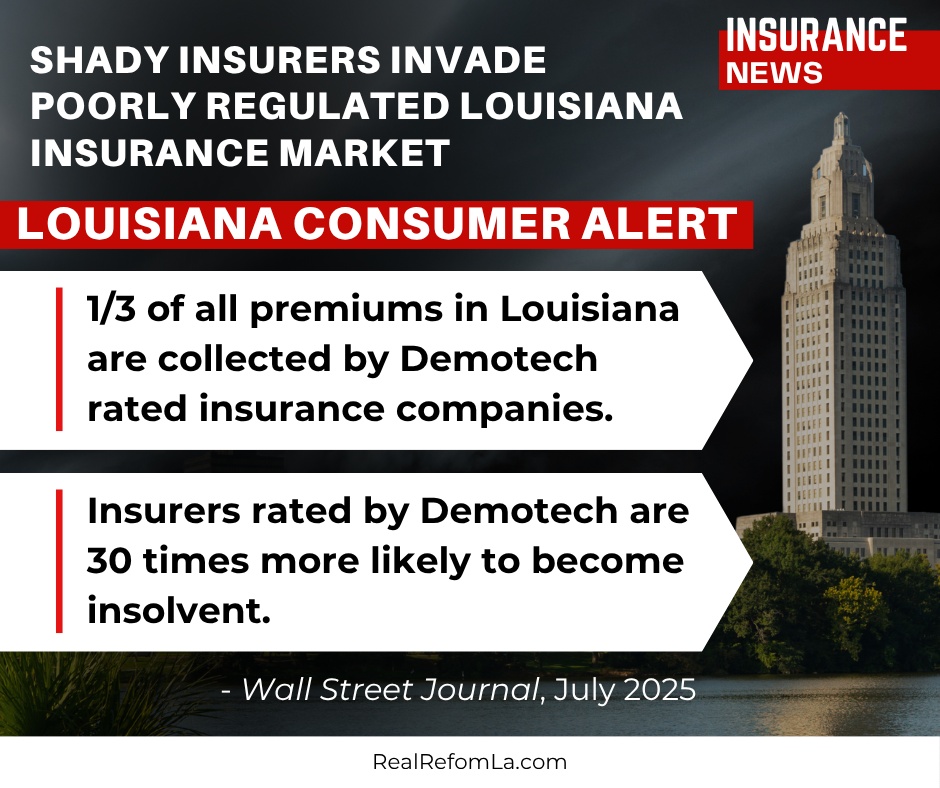

Rates Continue to Climb as Claims Paid Decrease Weiss Ratings, the nation's leading independent rating agency, issued a bombshell report that sheds light on "three alarming trends" with property insurers operating in Louisiana. The big takeaway: Tort reform does not work. The central argument from proponents of tort reform is that cutting costs for insurers will result in savings for policyholders. However, the data suggests that insurers are closing a startling number of claims without payment as rates continue to climb. According to Insurify , Louisiana rates are expected to rise another 27% in 2025, following a 38% increase in 2024. Additionally , Weiss Ratings found that eight property insurers who received taxpayer dollars through the Insure Louisiana Incentive Program "have a long history of poor business performance" and "above-average claims denials." Three Alarming Trends Insurance companies operating in Louisiana closed nearly half of homeowners' claims (44.6%) with no payment in 2024, which is significantly higher (+2.7%) than the national average and 18.9% higher than the national average in 2004. This highlights the devastating effects of tort reform. According to Weiss Ratings , seven companies operating in Louisiana closed more than 50% of their claims with no payment. Kin Insurance (68.3%) and Spinnaker Insurance (60.6%) closed more than 60% of claims with zero payment. Insurance companies operating in Louisiana have raked in "$88.3 billion from investments and other sources," far exceeding their "$1.6 billion in underwriting losses," which insurers often use to justify rate increases and tort reforms that gut policyholders' rights. "That’s $55 in profits for each $1 of underwriting losses," according to Weiss. Insurers operating in Louisiana moved $27.1 billion off the books to affiliates, effectively hiding these funds from regulators, lawmakers, and the ratepaying public. This could also account for a significant percentage of the underwriting losses reported by insurers operating in Louisiana. “Louisiana homeowners are being shortchanged by insurers prioritizing profits,” said Dr. Martin D. Weiss, founder of Weiss Ratings. “Regulators must act, and homeowners should choose insurers with fair practices and strong ratings.” Poor Stewards of Taxpayer Dollars The Insure Louisiana Incentive Program used taxpayer dollars to encourage insurers to write policies in Louisiana, particularly in storm-prone areas and to help depopulate the rolls of Citizens, the insurer of last resort. According to Weiss , the eight insurers approved to receive grant funds have reported "net underwriting losses of $357 million" over the last ten years. These insurers have shifted $174 million in fees to affiliate companies, off the books and out of sight of regulators, which accounts for 48.4% of their total underwriting losses. "On average, the eight companies closed 42.1% of claims with no payment in 2022, an even higher 45% in 2023, and an alarming 51.1% in 2024," according to Weiss. This disturbing trend demonstrates that insurers cannot be trusted to act in the public's interests with taxpayer dollars, as well as the devastating effects of tort reforms, which make it harder for policyholders to file claims. "We've heard the insurance industry repeatedly promise that tort reforms will reduce costs and ultimately lead to savings for policyholders. Sadly, we have seen rates continue to climb as the number of claims paid decreases," said Ben Riggs, executive Director of Real Reform Louisiana. "We cannot continue to trust and cater to the insurance industry. Louisiana families and small businesses desperately need real insurance reforms that lower rates, protect policyholders, and hold insurers accountable."